Reviews of the Best Forex Signal Service Providers

Subscribing to forex trading signals is a great way to diversify your trading by mirroring the trades of traders with a good track record. When choosing a forex signal service it is very important to find a reliable provider that doesn't manipulate results and make false statements.

Forex Signals

A forex signal is a trade alert for the currency market. Forex signals can be obtained from companies that specialize in this service, and also from a number of top forex brokers who provide them for traders of standard or V.I.P accounts. The price of this service can be anywhere from free if you receive it from your broker, to a daily average of $5-10 and higher depending on the individual or company providing it. There are also some packages that offer long term access for a one time subscription fee. In this case the floor is at around $100-150, reaching up to several hundreds.

Services that you receive upon signing up with a forex signals provider differ from firm to firm. You may expect to receive anything from performance trackers, sms, email, and online alerts, to customer support via email or phone, and advanced analysis in some of the more sophisticated offers. Since signals providers must protect their strategies, trading with them involves some degree of blind trust in the company or individual behind the issued signals.

The credibility of the many choices on the web varies widely, as it is often the case with anything related to the lucrative forex market. It is perhaps a good idea to approach any claims about 80-90 percent success rates with a pinch of salt, in spite of their ubiquity in the world of online trading. But there do exist some firms that provide genuinely valuable information and alerts to clients.

Keep in mind that your ability to successfully exploit received forex signals depends greatly on the efficiency of your broker's service. Especially with forex news based trading, you must act quickly, while being sure that any issues related to misquotes and slippage shall be minimal.

Forex Signals Can Be Classified Into Three Groups.

News Forex Trading Signals: This is the fundamental approach to forex signals, and the purpose is getting at the news release as early as possible, and exploiting it to maximum profit in the short period of time after the release. Such signals often come with some commentary and analysis on weekly and daily bases.

Technical Signals: Technical trading signals are just trading tips on the basis of technical analysis. You trust the background and track record of the company or person issuing the signals, so you choose to trade on that basis instead of entering your own orders.

Technical forex signals are often issued along with various risk management strategies to ensure minimal losses if the plan does not work out as expected. The vast majority of online forex signals belong to this category, which makes sorting the wheat out from the chaff a bit of a difficulty.

General Trade signals: This kind of service provides general trading tips for traders. Their alerts often employ a multi-pronged approach combining both fundamental and technical analysis.

Final Word

Whether you will use forex signals or not will mostly depend on your character and your plan in trading. If you're a highly active individual with little time to spend on analysis and study of the market, forex signals constitute an alternative to manual trading. If you want to learn the mechanics of trading, you will receive but a modest benefit from subscribing to forex alerts. A major discouraging factor about forex signals is the high price tag.

Content Source: forextraders.com/forex-signal-service-providers.html

Tuesday 10 May 2016

Wednesday 27 April 2016

Best Forex Trading Signals Review 2016

If you’re searching for the best forex signals, you already know the importance of having a reliable fx signals providers. To help you find the best forex signal provider to simply your trading career, we’ve reviewed numerous forex signal providers, so you don’t have to! Our expert editorial staff ranked and evaluated their features, services and products to bring you our list of the top 10 Forex Trading Signals Review Services. We invite you to read more about how we rated the top providers below according to price, customer rating, reliability and overall experience.

Top 10 Forex Signals Provider

| Ranking | Signal | Price | User Rating | Visit Site Sign Ups Recorded |

|---|---|---|---|---|

|  |

4.99

| Quick Tour | |

1 |  |

3/Week

| Quick Tour | |

2 |  |

97

| Quick Tour | |

3 |  |

97

| Quick Tour | |

4 |

47

| Quick Tour | ||

5 |

75

| Quick Tour | ||

6 |

97

| Quick Tour | ||

7 |

149

| Quick Tour | ||

8 |

99

| Quick Tour | ||

9 |

84

| Quick Tour | ||

10 |

80

| Quick Tour |

Content Credit: http://fxforex-trading.com/

Tuesday 5 April 2016

Forex Trading Strategy - Trading Strategies by Professionals

Nick's Forex Price Action Strategy

Welcome to the latest edition of my Forex trading strategy. My Forex trading strategy is based entirely on price action, no indicators, no confusing techniques, just pure price.

I have been developing, tweaking, and improving my price action strategy since 2005. This trading strategy is ten years in the making; it has survived major changes in market conditions, high volatility periods, low volatility periods and everything else the Forex market has thrown at it.

And that is the beauty of trading a price action strategy...

... Indicator based strategies are locked to the market conditions they were created for. Price action is fluid, it easily adapts to changing conditions, to different pairs, to different time frames and even to different traders. Most importantly, price action allows you to keep your trading simple.

Keeping Your Trading Simple

The key principle of my Forex trading strategy is to keep trading simple. I am against over complicating trading. Because the simpler your strategy is, the more effective you will be as a trader.One of the main goals of my price action strategy is to keep my charts clean. The only thing I place on my charts are support and resistance areas. I use these support and resistance areas in conjunction with candlestick analysis to trade Forex. Packing my charts full of indicators would make it impossible for me to read price action.

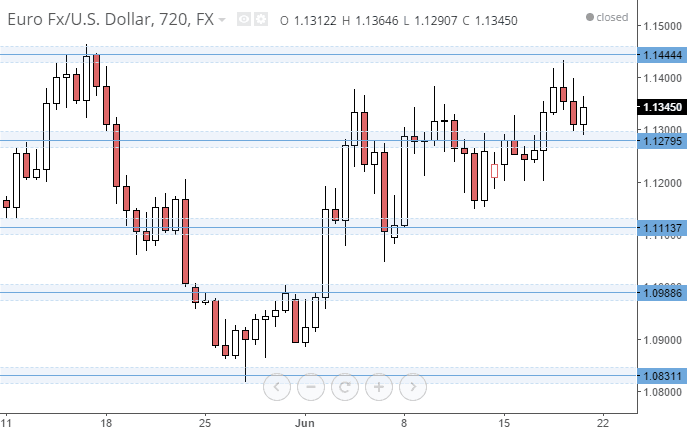

Trading with no indicators makes my Forex trading strategy simple, stress free and highly effective. What does a clean Forex chart look like? Here's a picture of my EUR/USD 4hr chart.

My clean and simple Forex trading strategy

Some trading strategies are an absolute mess of indicators. Check out the image below, some people actually trade like that!

A messy indicator based Forex strategy

Indicators Required for this Trading Strategy

So to trade my Forex Trading Strategy I use no indicators.I generally don't like using Forex indicators, as I find the data worthless, as they lag current price. If you want to be in the moment and take trades based on what's happening right now then you have to base trades on current Price Action.

Which Currency Pairs can you Trade Successfully using Forex Price Action?

My Forex Trading Strategy will work on any currency pair, which is free floating and regularly traded.This is because my method is based on Price Action. This means you can use this trading strategy to successfully trade any currency pair you find on your Forex trading platform.

That being said, I personally prefer to concentrate on just a few currency pairs at any one time. I find it too distracting to try and keep track of too many pairs at once.

I mainly trade the EUR/USD, USD/CAD and AUD/USD. I generally trade these currency pairs as they are the most predictable and their movement is smoother. You don't find random jumps unless there's been some highly unexpected news, which is pretty rare.

If you prefer to trade a particular Forex session such as the London, New York and Asian session then choose the main currency pairs that are active at those times.

Price Action Trading Works Better on Longer Time Frames

Since this Forex Trading System is based on Price Action you can trade any time frame from one hour and above.I mainly concentrate on the one hour, four hour and daily charts. These are consistently the most profitable, as the patterns are easier to spot and lead to more consistent profits.

Types of Price Action Analysis

Primarily, I use two forms of Price Action Analysis:- Support and Resistance lines.

- Candlestick analysis.

How to Enter Trades using My Forex Trading Strategy

Due to the recent economic uncertainty and countries losing their credit ratings etc, currencies aren't trading as they normally would. This has led to me to trade reversals exclusively.I look for strong reversal setups forming on top of my Support and Resistance areas. Once a pattern forms, that indicates a reversal, I set up a trigger price and enter the trade. I take several trades each week and average at least an 80% win rate.

Trading Strategy Targets and Stops

Targets: My targets are on average 80 pips.Stops: My stops are on average 40 pips.

These targets and stops differ during different market conditions. I usually allow price action to determine my target and stop. This means I will read the candles and set my stop based on recent highs and lows. A common place for a stop will be above or below the most recent high or low.

How to Adjust the Trading Strategy Around News Releases

I use the Forex Calendar from forexfactory.com to keep track of economic data. Statistically I have found that I do not need to avoid trading during high impact news releases. In fact, by trading through most news releases, I end up making more profit...... Why is this?

Banks and other large trading institutions pay millions for analysts and data feeds; this allows them to make educated guess about upcoming economic data releases. These guesses are factored into price before the data is released.

If a trade set up forms before a major economic data release, it can be a sign that large institutions are position themselves for the release. If price action is telling you to short, there is usually a reason!

The only news I avoid is unpredictable news or very high impact news, here is a quick list:

- Speeches by central bank leaders or politicians.

- Interest rate announcements or anything directly related to interest rates.

- NFP report, the name changed a while ago to the "Non-farm employment change" report..

For the most part, news can be safely ignored. The only thing I do not do is enter a trade that is triggered by a news release. News based moves tend to retrace quickly, so if I have an entry trigger, I remove it before any major news release.

As you can see, my Forex Trading Strategy is straightforward and will allow you to make pips in any market conditions, with almost any Forex currency pair.

Original Content Source : https://www.forex4noobs.com/forex-trading-strategy/

Wednesday 30 March 2016

Best Forex Strategies For Part-Time Forex Traders

Very

few people are available to trade forex full time. Often traders make their

trades at work, lunch or night. The problem with this type of trading is that

with such a fluid market, trading sporadically throughout a small portion of

the day creates frequent missed opportunities to either buy or sell. This could

mean a complete loss of funds if a position is not existed before the market

moves against it or a loss of opportunity to buy at a desirable price. These

missed opportunities can spell disaster for the part-timer trader.

However,

there are Forex Trading Strategies that can work based on a part time schedule. For example,

those who trade at night might be limited to the types of currencies they trade

based on volumes during the 24-hour cycle. These night traders should employ a

strategy of trading specific currency pairs that are most active during the night

time hours. An example would be trading the Australian dollar (AUD) / Japanese

yen (JPY) pair or something a little less known like the New Zealand dollar

(NZD)/JPY or AUD pair. It is extremely useful to look at the correlation

between the two currencies when choosing a pair, so having a block of time

during the day to study the market and implement trades can lead to a

successful strategy. (Learn how

to set each type of stop and limit when trading currencies. Check out How To Place Orders With A Forex Broker.)

The

main problem comes with true part-time traders who might pop in and out

throughout the day. These traders have time constraints and may only be

available to trade for an hour or two per day or even per week. Here are some

strategies for trading part time when you have an inconsistent schedule.

Know Your Markets

Assuming you work nine to five in the United States, you could trade before or after work. The best strategy for trading in either block of time is to pick the most active currency pairs during that time. Knowing what times the major currency markets are open will aid in choosing major pairs.

Assuming you work nine to five in the United States, you could trade before or after work. The best strategy for trading in either block of time is to pick the most active currency pairs during that time. Knowing what times the major currency markets are open will aid in choosing major pairs.

|

New York

opens at 8:00 am to 5:00 pm EST

|

|

Tokyo

opens at 7:00 pm to 4:00 am EST

|

|

Sydney

opens at 5:00 pm to 2:00 am EST

|

|

London

opens at 3:00 am to 12:00 noon EST

|

During

the 12:00-2:00 am time, the markets in Japan and Europe (open 2:00 am – 11:00

am) are in full swing so part-time traders can choose major currency pairs such

as the EUR/JPY pair or the EUR/ CHF pair for major currencies or look to other

pairs that involve the Hong Kong dollar (HKD) or Singapore dollar (SGD) for

example. During the 5 pm to midnight time frame, trading the AUD/JPY pair is an

available choice for this time period. Despite the pairs the part-time trader

chooses, before placing any bets, the trader needs to understand the market by

studying the technicals for these pairs as well as the fundamentals of

each currency.

Stop-Loss Orders

Assuming you can only trade for a minimal amount during the day, for example, one hour, the best strategy may be to let your computer be your "trading partner." Because the forex market is so fluid, not having the flexibility to watch the market may leave you with numerous missed opportunities, so employing a trading program where you can let the information technology work for you might be the best strategy. Another common strategy is to include setting stop–loss orders such that if the market takes a sudden move against your position, your money is protected.

Assuming you can only trade for a minimal amount during the day, for example, one hour, the best strategy may be to let your computer be your "trading partner." Because the forex market is so fluid, not having the flexibility to watch the market may leave you with numerous missed opportunities, so employing a trading program where you can let the information technology work for you might be the best strategy. Another common strategy is to include setting stop–loss orders such that if the market takes a sudden move against your position, your money is protected.

Price Action

Assuming you pop in and out while you work (10 minutes at a time), a strategy that can be used during these brief but frequent trading periods may be to use price action trading. Price action trading can be described as analyzing the technicals or charts of the currency pair and trading based on what the chart tells you. In its most basic definition, traders can analyze up bars, which is a bar that has a higher high or higher low than the previous bar, and look at down bars, which is a bar with a lower high or lower low than the previous. Up bars signal an uptrend while down bars signal a down trend. Other price action indicators may be inside or outside bars. Choosing the chart time frame that best meets your schedule availability is key to success with this strategy. (Learn to bank short-term profits by placing stops away from the crowd. See Stop Hunting With The Big Forex Players.)

Other Strategies

Assuming you cannot even trade for an entire hour or for regular increments during the day, you can still trade the forex market. Since you cannot watch the market during the day, the following strategies may be implemented so you can be a successful part-time forex trader:

Take

fewer positions and hold for days.

After studying the market and narrowing down particular chosen currency pairs, you can take only a few positions and hold these positions for a longer period of time. It is critical that you understand the drivers of your currency pairs and have taken the time to really understand your market. Another wise strategy is to put in stop-loss orders with all your trades to minimize any losses if the market moves against you.

After studying the market and narrowing down particular chosen currency pairs, you can take only a few positions and hold these positions for a longer period of time. It is critical that you understand the drivers of your currency pairs and have taken the time to really understand your market. Another wise strategy is to put in stop-loss orders with all your trades to minimize any losses if the market moves against you.

Look

at long-term trends.

Instead of looking at hourly or even four-hour charts, you may want to look at the trends for a day or week. This will allow you to trade while looking at your computer only once a day.

Set

up trading orders.

Setting limit, stop-loss or other entry/exit orders can ensure you do not miss opportunities to enter or exit positions. Most trading platforms allow you to set up these orders with no additional fees.

Use

technology!

Set up auto alerts to your mobile phone or email to keep you informed while you are not actively trading.

The Bottom Line

The forex market is one of the most desirable markets to trade because it is a 24-hour market that is constantly in flux, providing ample opportunities to make profits at any point in the day. Because of these features, the forex market lends itself to part-time traders. However, despite these favorable characteristics, the forex market is very volatile, which makes it risky for all traders, particularly the part-time trader, if the proper strategy is not implemented.

Trading specific currency pairs that are at play during the times

of day you can trade, looking at longer time frames, implementing price action

strategies and employing technology are all strategies that will help you

become a successful part-time forex trader. Other things to consider are understanding

your level of understanding and tolerance for risk and leverage, as well as

your time horizon (from hourly to weekly). These all elements that are an

important part of any trading strategy. (Most brokers will provide you with

trade records, but it's also important to keep track on your own. Check out 4 Reasons Why You Need A Forex Trading Journal.)

Content Credit: http://goo.gl/gwjptL

Tuesday 2 February 2016

Forex Trading Strategies

Countless Forex trading strategies have been invented over the

years, some relying on technical use of charts and numbers and others

relying on a fundamental understanding of the market with reference to

current events. Some have become very popular while others are only used

by a minority of traders.These trading strategies range in different

levels of complexity. We will now discuss some of our expert’s favorite

strategies starting with a rather simple one and moving up the

complexity scale as we go along.

2. Support and Resistance Levels Forex Trading Strategy

Every forex trader, advanced or novice, should learn how to look for support and resistance levels on the charts. It doesn't matter if you trade Forex, commodities, stocks or any other instruments, this strategy will serve you as a baseline for your trading activity and analysis. The best thing about support and resistance levels is that a good trader can spot them even on a "naked" chart since they are easy to identify.3.Fibonacci Indicator Forex Trading Strategy

One of the most famous and popular forex trading strategies is Fibonacci, named after the famous Italian mathematician. Considered as a medium-long term trading strategy, we use it to follow repeating support and resistance levels. History shows that the market moves in waves and Fibonacci takes advantage of this fact. Fibonacci ratios can help us identify potential resistance and support levels on the financial charts. The most common ratios are 61.8%, 50% and 31.8%4. Multiple Time Frames Forex Trading Strategy

We at FX Market Leaders love to use this method to double-check the trading decisions that our analysts take. The way to use this trading strategy is to follow a certain currency pair over different time frames. By analyzing different time frames we can spot trends on bigger and smaller scales and make a better analysis of the overall trend. While there is no limit on how many time frames to follow, we recommend to look at not more than 3-4 time frames simultaneously. A good combination can be 15 minutes chart + 30 minutes chart + 5 hours chart.5. Scalping - Short Term Forex Trading Strategy

Many novice forex traders find scalping to be a great technique. Scalping is a very low-risk strategy but nevertheless allows a strong trader to make enormous profits. This trading strategy requires a great amount of patience and awareness and although it is low risk it is still very hard for novice traders to profit from it. Emotions must be set aside as they lead to compulsive actions which do not work with scalping at all.6. Horizontal Levels Forex Trading Strategy

Understanding horizontal levels is considered by many as one of the first things that a novice trader should learn. Horizontal levels help us analyze the charts and are mostly used in combination with other Forex trading strategies, but can also be used on their own as a standalone method for trading.7. ADX (Average Directional Index) Forex Trading Strategy

This unique indicator works a bit differently from the rest of the FX indicators that traders usually use, because it indicates the strength of a market trend, and not its direction. We believe that it is a great tool for traders who are a bit more advanced and wish to get an extra help for their trading decisions from an additional indicator. The reason for its popularity is that we know that by placing a trading position at the same direction of a strong, solid trend, we increase our potential for earnings while at the same time we reduce the level of risk that we take.8. Carry Trade Forex Trading Strategy

If you are an advanced trader who is looking for an alternative way to profit from your trade on the long run, then Carry Trade might be a good technique for you. In our article about carry trade we explain thoroughly how to use carry trade so you will be able to understand the concept behind this strategy.9. Candlestick Forex Trading Strategy

Candlestick charts are the most common chart types used by retail traders and investors. There are other types of charts such as line charts, bar charts etc., but they don't tell the story of past price action like candlesticks do and when trading is based on technical analysis, the decisions for future price action are made based on how the price has reacted in the past. I find candlesticks to be very useful and they are one of my favorite indicators. They work almost perfectly in volatile times, but even in less volatile times they work pretty well if used in combination with one or two other indicators.10. Head and Shoulders Forex Trading Strategy

Head and shoulders or as they appear on the Forex jargon “Shampoo” because of the shampoo with the same name, are one of many recognizable and tradable chart patterns. It consists on a high peak in the middle and two double peaks either side of that one. The higher peak is the head and the other two lower ones are the shoulders. The pattern itself looks like a head between two shoulders, hence the name.11. Trend trading Forex Trading Strategy

FXML’s top analysts use trend trading as one of their leading trading strategies and always check which side of the trend they are on before making a trade or signal. The main idea behind ‘Trend Trading’ is picking a top or a bottom. Novice traders tend to think that trend trading is easy; just find the trend and trade alongside it. In practice, it’s not that easy, as with all other aspects of this game, many dilemmas pop up when trying to identify the trend.12. Divergence Forex Trading Strategy

Divergence is a leading indicator used by our analysts at FXML and helps to significantly increase profits. The likelihood of entering in the right direction at the right time increases if used alongside other indicators such as Moving Averages (MA), RSI, Stochastichs, Support and Resistance levels etc.13. Trading the News Forex Trading Strategy

Big announcements or news coming out of different countries can have a huge effect on the market, rendering all our analyses meaningless. In this article you will learn how to use the news in order to make profit.14. Hedging Forex Trading Strategy

Traders of the financial markets, small or big, private or institutional, investing or speculative, all try to find ways to limit the risk and increase the probabilities of winning. There are many Forex trading strategies out there and hedging is one of them. In fact, hedging is one of the best strategies to do just that, that's why many large institutions use it as a mandatory component of their tactics.15. The Strategy to Trading majors in 2015

Big investors, hedge and pension funds as well as good traders lay out plans and strategies in advance, usually before the quarter or a new year begins on both, fundamental and technical outlook. So we are suggesting a strategy to figure out 2015 in advance.16. Trading moving averages

As traders, we have to take into consideration many things. We have to implement different factors and indicators in our analysis in order to succeed in this business, no matter if you trade short or long term. These might be fundamental indicators, technical indicators, or both. On the other hand, we shouldn´t overcrowd the charts with too many indicators that will contradict each other and cloud our judgment.17. Trading the Market Sentiment

We all know that trading in the Forex market is not easy. Sometimes every technical indicator points to a certain direction but the market moves in the other direction. Other times the fundamental outlook of an economy is very bearish for the currency of that country, yet it keeps moving higher against other currencies.18. Triangles and Wedges strategy

We have covered most of the important technical chart patterns in our strategy section during 2015. There are still some strategies left though. “Triangles” and “Wedges” are two of the 10 most important chart patterns and in this article we´ll explain how to trade them. It´s true that they are different patterns, but they are very similar so we´ll teach both of them in one article.19. Creating a trading plan- Part 1

We have heard many times that new Forex trader's fail 80% of the time. That’s because many beginners start trading without a clear plan. A premeditated plan is crucial when you trade. It´s like going to war without an attack and a defense plan. Before you go into a battle you assess your capability, your strengths and your weaknesses. The same logic applies to Forex, you prepare a plan that helps you base your trading on your strongest features and avoid the weak ones.20. Creating a trading plan- Part 2

A little while back, I wrote about how to build a trading plan. The trading plan is very important so we thought it would be better if we only published half of it, the first part. It would give you some time to practice the first two steps, your available funds and your available time. This week we are publishing the second part of the trading plan with the two remaining steps.21. Elliot Wave Theory: The background

New strategies breathe life into the market, so we are presenting the ‘Elliot Wave Theory’, named after Ralph Elliot. Having nothing in particular to fill his days, Elliot turned his attention to the stock market behavior and developed his theorem in later stages of life. Born an accountant, but retired at age 58 after catching a virus from a trip to South America. This is one of the oldest trading strategies, first published in 1938 as a book under the name ‘The Wave Principle’.22. Trading with the Elliot Wave Theory: Part 2

A couple of weeks ago we published an article where we explained how the Elliot Wave Theory was developed and how it worked. When used alone as a principle it’s useless unless implemented in everyday trading. So this week we will explain how to trade with the Elliot Wave Theory (EWT), after all that´s what we need it for! When you use EWT you trade the probability which this system offers;23. Trading with Ichimoku

The Ichimoku Strategy is an abbreviation of the Ichimoku Kinko Hyo, which was developed by a Japanese journalist named Goichi Hosoda in the 1960s after 30 years of working within this indicator. This technique has been popular in Japan for quite some time now and it has gained popularity in other parts of the world as well.24. The importance of liquidity in the Forex market

Liquidity has been an important factor since ancient times and it continues to this day. A person, company or a country can be very wealthy but if they don´t have enough liquidity or liquid assets they can bankrupt easily. Very often we hear about liquidity or the lack of it, especially during the 2008 financial crisis.Content Credit: http://www.fxmarketleaders.com/forex-strategies

Subscribe to:

Posts (Atom)